Verification: The monetization associate may possibly accomplish a last verification to make certain that all disorders are achieved and which the SBLC is in compliance With all the settlement. That is to shield their pursuits and make sure that the transaction is safe.

Like all organization bank loan, you must show your creditworthiness towards the bank. Having said that, the approval system for an SBLC is considerably faster, with letters generally getting issued inside of a week In spite of everything necessary paperwork continues to be submitted.

El almacenamiento o acceso técnico es necesario para crear perfiles de usuario para enviar publicidad, o para rastrear al usuario en una World wide web o en varias World wide web con fines de promoting similares.

Using devices can be a essential Instrument for financial benefit, sustaining a stable financial state and facilitating Worldwide trade.

An SBLC acts as a “standby” warranty. When the applicant fails to satisfy contractual terms—such as paying for products or finishing a project—the beneficiary can claim the SBLC by presenting required documents on the issuing bank.

SBLC monetization has various implications with the get-togethers included. For the beneficiary, SBLC monetization offers fast cash or credit score, which can be used to finance their operations or pay off existing debt. For the issuer on the SBLC, SBLC monetization is often considered as being a breach of contract, since the SBLC was not meant to be monetized.

The SBLC monetizer requires on the danger affiliated with the SBLC and assumes duty for making certain that the SBLC is valid and enforceable.

Central financial institution purchases of devices may have a significant impact on the worldwide overall economy. Every time a central lender buys up substantial amounts of bonds, one example is, it places downward pressure on curiosity prices, which may promote economic growth.

The SBLC can be assigned or transferred on the monetization partner, along with the beneficiary’s bank might issue a payment undertaking to the monetization associate.

The disbursement period is a crucial phase in the process of monetizing a Standby Letter of Credit (SBLC). Throughout this stage, the monetization spouse gives the beneficiary (the holder from the SBLC) Using the funds or economic instruments as arranged while in the monetization arrangement. Listed here’s a more specific clarification of the disbursement course of action:

A standby letter of credit history aids facilitate Worldwide trade amongst firms that don’t know each other and have unique guidelines and rules.Just click here to go through our extensive short article on standby letters of credit (SBLC).

The treatment of SBLC monetization varies internationally because of accounting diversity, especially in recognition timing of economic instruments, underneath specifications like IFRS and GAAP, impacting the money statements and similar disclosures.

Research need to include things like a review of your terms and conditions in the SBLC, the economical energy with the issuer, and also the track record from the monetizer. The parties also needs to search for sblc provider authorized advice to make certain that the SBLC monetization method is lawful and complies with applicable rules and restrictions.

Instead, the collateral serves as protection to the mortgage, plus the lender can only obtain the collateral in case of default.

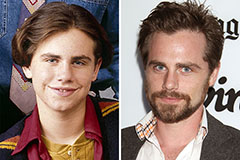

Rider Strong Then & Now!

Rider Strong Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!